By Cassia PazPublished On: September 6, 2023Categories: Daily Market News & Insights, What Is It Wednesday

In the grand theater of fuel production, refinery utilization is a critical metric for gauging the pulse of the oil market. But what is it, and why does it matter so much, especially for powerhouse producers like the United States? Today’s What Is It Wednesday article will answer that and other questions you may have in regard to refinery utilization.

What is refinery utilization?

Refinery utilization is a measure that tells us the proportion of a refinery’s actual crude oil processing relative to its maximum capacity. In simple terms, it answers the question: How much of the refinery’s potential is being used to produce fuel? This percentage can be calculated by dividing actual throughput by nameplate capacity. Actual throughput represents the volume of crude oil the refinery processes during a specified period, and nameplate capacity is its designed full-load sustained capacity. For instance, a refinery with a nameplate capacity of 100,000 barrels per day (BPD) that operates at 95,000 BPD would have a utilization rate of 95%.

Typical US Refinery Utilization Rates

U.S. refineries process more crude oil daily than the nation produces. With the intense task of producing more finished fuels than what the U.S. consumes, the country’s refineries often work in the higher echelons of their capacity. A rate of 90% or above is deemed “high” for the U.S., illustrating the nation’s immense refining prowess. However, pushing these gigantic facilities to their absolute limits for extended periods is neither sustainable nor safe.

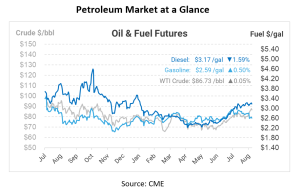

As seen in the chart below, refinery utilization tends to fluctuate between 80%-100%, depending on the time of year. Compared to other nations, U.S. refineries tend to operate at relatively high utilization rates, given the country’s robust domestic and export demands.

It’s been decades since the US built a new refinery, so the total US refining capacity has been somewhat flat for a while. Major changes typically come when a refinery is closed, which has happened most notably to East Coast refineries, or when existing facilities make upgrades to expand their capacity.

This time last year, refinery utilization in the U.S. stood at 90%. This rate typically climbs in the second quarter, aligning with the onset of the summer travel peak. Historically, it’s not until September that we observe utilization rates falling beneath the 90% mark. Interestingly enough, last winter witnessed refinery utilization rates beyond 95%. With gasoline stocks being 7% lower than the five-year average for this time, the projection is that refineries will maintain high utilization rates.

Reasons Refineries Don’t Always Run at 100%

There are three main reasons for refineries to run below 100%: planned facility maintenance, natural disasters, and drops in demand. Typically scheduled during the first or second quarters of the year, these downtimes coincide with the U.S.’s lower fuel demand periods. During these maintenance windows, certain units or even entire sections of the refinery may be shut down, thereby reducing the facility’s overall throughput.

Refineries are large installments often situated near coasts or waterways for logistical reasons. This positioning makes them susceptible to natural calamities such as hurricanes, floods, and earthquakes. When a natural disaster is anticipated, especially events like hurricanes, refineries might preemptively shut down as a safety measure. Post-event, the duration of the shutdown can be extended depending on the severity of the disaster and the damages incurred.

The demand for refined products isn’t constant. It can vary based on economic conditions, technological shifts, societal behaviors, and unexpected global events. Over time, sustained low demand can even lead to prolonged reductions in refinery throughput or temporary closures of certain units.

The Bottom Threshold: Turndown Rate

There’s a baseline utilization below which refineries cannot safely function without risking equipment damage or compromising the quality of the output. This threshold is known as the “turndown rate.” For most refineries, this stands at about 65% to 70% of their total capacity. During the early phases of the COVID-19 lockdowns, U.S. refinery utilization teetered precariously at this rate, with figures dropping to 68%. From an economic perspective, operating below the turndown rate might not be cost-effective. The energy and resources needed to run the refinery might outweigh the benefits derived from the reduced output, leading to financial losses.

This article is part of Daily Market News & Insights