By Sydney CaseyPublished On: November 7, 2023Categories: Daily Market News & Insights

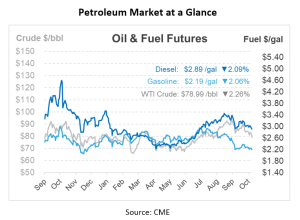

With WTI crude slipping below the $80/bbl mark and RBOB futures plunging under $2.20, the crude oil landscape seems to be shifting. Diesel’s backwardation is showing signs of narrowing, yet the fundamental supply metrics do not seem to align with these price movements. Persisting below a 30-day threshold for the past month, the diesel supply is tight. The situation is particularly acute in Padd 1, where supply tightness looms with the winter season approaching. Despite the East Coast’s up-and-down supply dynamics remaining fluid, suppliers are taking a cautious stance, holding back inventories instead of selling, a move reflected in the widening profit margins for diesel.

Markets seem to be more concerned about the long-term demand situation, which is echoed by the recent decline in the rig count. At their lowest levels since February 2022, the rig count was down seven rigs last week and surprisingly left the market unbothered.

Regional dynamics have been at play, showing shifts in Chicago diesel, which over the summer was trading between 30-80c/bbl but is now up 15c/bbl above the futures market due to unplanned refinery setbacks. Regional price swings such as these mark an imbalance between the production and supply/demand relationship but also hint at the underlying scarcity of supply in our current backwardated market.

Texas remains a development hub, with infrastructure projects expanding to meet demand. Citgo is constructing a new terminal in Luling, while Enterprise Products is repurposing a natural gas pipeline and building four new terminals due to begin operations in 2024, spanning from Odessa to Albuquerque and extending into Colorado.

Globally, concerns over Chinese fuel demand are influencing crude prices, with a decrease in exports and refinery utilization rates despite a spike in crude imports. A stronger dollar is adding further downward pressure. Domestically, US crude refiners are scaling back production after a summer of high output (above 95%), aiming for lower utilization rates below 95% due to the slump in gasoline margins. A shift towards distillate production is reducing gasoline output, aligning with the seasonal maintenance schedules.

The US Department of Energy has announced intentions to purchase up to 3 million bpd of crude oil scheduled for delivery in January 2024 to refill the Strategic Petroleum Reserve. This follows on the heels of an earlier announcement where the DOE outlined a purchasing strategy for 6 million bpd of crude, targeting deliveries for the last month of 2023 and the first month of 2024.

US crude oil exports are on the rise as a record number of supertankers are set to load oil in the coming months. Over 40 of these vessels are slated to dock in the US, marking a six-year high. Anticipated to increase by 100,000 bpd, crude exports from the U.S. Gulf Coast are projected to reach 4.1 million bpd in the coming month. This increase in tanker traffic is partly due to OPEC+ reducing their output, leading these tankers to venture away from the Middle East in search of oil to transport.

This article is part of Daily Market News & Insights