By Sydney Casey Published On: December 5, 2023Categories: Daily Market News & Insights

OPEC’s recent extension of production cuts has no doubt influenced crude oil futures. Also concerning to markets right now is the news of US diesel shippers being rerouted and causing major delays and the challenges faced by the US Strategic Petroleum Reserve (SPR) in maintaining adequate levels amidst fluctuating oil prices and physical constraints.

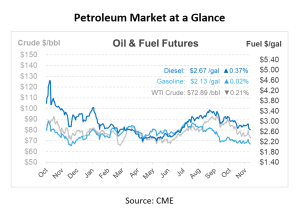

Crude oil futures have been trading down ever since the announced production cuts from OPEC’s meeting last week. This morning, crude futures are down 15c/bbl following yesterday’s closing of 85c/bbl lower to $78.03 per barrel. Markets are anticipating looser crude balances after OPEC’s decision to extend production cuts. The WTI for January 2024/February 2024, which closed 10 c/bbl lower on Monday at -28 cents per barrel, is reflective of the fear of oversupply. Similarly, the Brent prompt spread for February 2024/March 2024 ended 15 cents lower at -4 cents per barrel, indicating a market in contango.

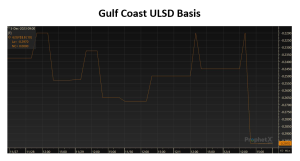

Diesel prices also ended Monday’s session lower, with Gulf Coast spot diesel values experiencing a more significant drop. This is partly a reflection of refinery restarts, which have the potential to stabilize crude oil prices and increase the availability of diesel, heating oil, and jet fuel. Historically, the first half of December often sees an increase in refinery utilization, indicating potential further increases in the upcoming EIA report.

For the first time, diesel shippers in the United States are being forced to navigate around South America’s southern tip to reach Chile, circumventing increasing congestion in the Panama Canal. This detour extends the journey by approximately one week compared to the traditional Panama Canal route. With freight rates approaching unprecedented levels, the expense of transporting fuel from the US Gulf Coast to Chile has increased significantly. By late November, this cost reached an all-time high of $3.6 million, effectively doubling since the start of the year.

The Department of Energy has reported challenges in taking advantage of the recent drop in oil prices to refill the U.S. Strategic Petroleum Reserve (SPR) despite the continued decline of oil prices. Due to physical constraints and maintenance issues in the Gulf Coast underground caverns, the purchase capacity is limited to about 3 million bbls per month. Despite these limitations, Deputy Energy Secretary David Turk has affirmed the government’s commitment to refilling the SPR as much as possible. The Federal Reserve Bank of Dallas noted that emergency drawdowns and planned sales since 2020 have brought the U.S. SPR to a 40-year low. However, in comparison to historical averages, the current inventories are still about double, even at these reduced levels. Relative to gross oil imports, the inventory levels provide about 55 days of import cover, which is low by historical standards.

This article is part of Daily Market News & Insights