By Cassia PazPublished On: July 17, 2023Categories: Daily Market News & Insights

In a promising turn of events, the U.S. economy is projected to experience a surge in growth, fueled by revised forecasts and various factors shaping the energy landscape. The latest EIA’s Short-Term Energy Outlook (STEO) reveals exciting developments that are set to impact multiple sectors in the coming months.

The forecast for the U.S. Gross Domestic Product (GDP) has been revised upwards, indicating a more optimistic outlook. The EIA now predicts GDP growth of 1.5% in 2023 and 1.3% in 2024, compared to the previously projected figures of 1.3% and 1.0%, respectively. The revision is attributed to higher-than-expected consumer spending and aggregate investment, particularly in the first quarter of 2023, underscoring the nation’s resilience in the face of economic challenges.

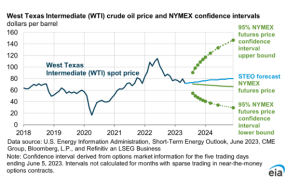

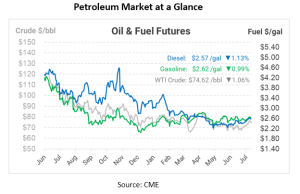

Another significant factor driving this economic growth is the anticipated rise in crude oil prices. The Brent crude oil spot price is forecasted to reach an average of $78 per barrel in July, with a gradual increase to $80 per barrel by the fourth quarter of 2023. This positive trajectory is driven by expectations of declining global oil inventories over the next five quarters. As a result, the energy sector can anticipate increased stability and favorable conditions for further investment. Since the US is an exporter of petroleum, rising prices positive affect its national economy.

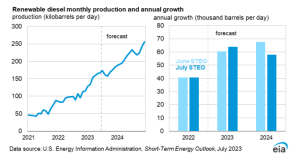

However, the renewable diesel production is expected to experience a slight downward adjustment due to the Environmental Protection Agency’s (EPA) revised Renewable Fuel Standard (RFS) rule. Although the forecast for renewable diesel production growth has been reduced, there is still optimism surrounding the sector’s expansion. The revised projection indicates that renewable diesel production in the United States will reach 219,000 barrels per day by 2024, reflecting the nation’s commitment to sustainable energy solutions.

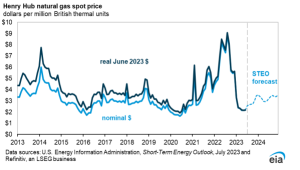

Simultaneously, the natural gas market is undergoing a transformation. Declining natural gas production is expected to diminish the existing surplus of inventories, thus driving up prices. The Henry Hub spot price is forecast to rise to more than $2.80 per million British thermal units (MMBtu) in the second half of 2023.

With a revised upward growth forecast for the U.S. economy, a rise in oil prices, and ongoing developments in renewable energy and natural gas markets, the nation is poised for an exciting period of transformation. As the energy landscape evolves, it presents new opportunities and challenges, prompting industries and individuals to adapt and thrive in this dynamic environment.

This article is from https://mansfield.energy