By Sydney CaseyPublished On: July 11, 2023Categories: Daily Market News & Insights

Texas has been grappling with extraordinary high temperatures. Mid-July witnessed a record peak of 103F in the Midland-Odessa region, continuing the trend of unusually warm days. In the preceding four days, the area saw temperatures nearing the 100F mark.

As temperatures soared, questions emerged regarding the potential impact on the state’s critical oil and gas operations. An inquiry made to the Texas Independent Producers and Royalty Owners Association (TIPRO) on this subject revealed that most operations were unaffected by the heatwave. Despite the harsh conditions, significant disruptions were not reported.

The increased temperatures posed unique challenges to some operators, making it harder to function than during the winter months. Reports of difficulties with equipment such as compressors, electrical submersible pumps, and propane refrigeration at gas plants were also shared, causing minor and short-lived disruptions.

In response to the intensified heat, operators implemented protective measures for their crews, adjusting work hours to avoid the hottest parts of the day, providing increased breaks, and emphasizing the importance of hydration.

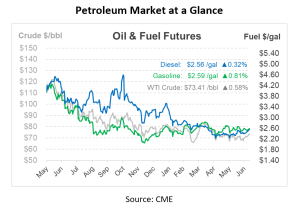

In the broader oil market, prices have been inching upwards, fueled by bullish sentiment resulting from Saudi Arabia’s supply cut and Russia’s reduced oil export pledge. Market trends are being closely watched, with upcoming US economic data set to provide an insight into the potential for rate hikes and the impacts of OPEC+ output reductions.

Concerns about economic health and future interest rate hikes loom large. Warnings from Chinese economic data hinting at deflation and US Treasury Secretary Yellen’s statement about the risk of a US recession have raised eyebrows in the industry.

The International Energy Agency’s (IEA) head, Fatih Birol, has forecasted a possible tightening of the oil market in the latter half of this year due to oil demand from China and developing countries and OPEC+ supply cuts. He stated that non-OECD countries are expected to contribute up to 90% of global oil demand growth this year. This forecast is eagerly awaited in the IEA and OPEC+ monthly reports later this week.

China, a significant player in the global oil scene, has asked for reduced supply from the world’s biggest oil exporter, Saudi Aramco. A few Chinese refineries have sought lower supply in August due to high Saudi oil prices, leading to a predicted reduction of about 8 million barrels compared to July.

This article is from https://mansfield.energy